Financial Well-being – White Recruitment

What is financial well-being at work?

We look at ways to support our team with their financial goals and aspirations.

The Starting Point

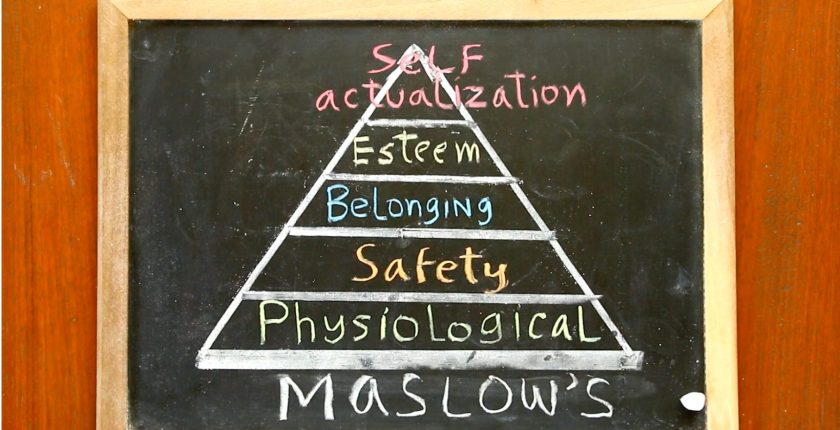

For anyone who is familiar with Maslow’s Hierarchy of Needs you will know that there are many factors that contribute to a person’s well-being to support them on their journey to succeed.

There are some criticisms to his work, that in fact, have been identified when analysing human needs and motivations across cultural contexts and that linear progression doesn’t reflect the modern complex dynamic nature of human motivation.

As a company we like to look at Maslow’s theory in a more holistic way, identifying that all aspects of the pyramid are a contributing factor to employee motivation and well-being. With this in mind we have applied our financial well-being strategy to reflect the key indicators of human behaviour.

Why?

Financial well-being at work refers to the state of an employee's financial health and security within the context of their job and workplace environment. It involves providing resources, support, and opportunities that enable employees to manage their finances effectively and achieve a sense of stability and confidence in their financial lives. Financial well-being programs and initiatives in the workplace aim to help employees make informed financial decisions, reduce financial stress, and improve their overall financial situation.

Promoting financial well-being at work benefits both employees and employers by fostering a more engaged, satisfied, and productive workforce, while also contributing to a positive workplace culture and overall organisational success. Most importantly, there is a responsibility for everyone to ensure the well-being of those around them is fostered and nurtured.

Supporting financial well-being at work is crucial for several reasons:

Employee Productivity and Engagement

When employees are stressed about their finances, it can negatively impact their focus, productivity, and overall engagement at work. By offering financial support and resources, employers can help alleviate this stress and create a more focused and motivated workforce. Stress at work can make an employee feel unsafe, unwell and dissatisfied. It can also lead to burnout - SAFETY NEEDS

Retention and Recruitment:

Providing financial wellness programs can enhance employee loyalty and reduce turnover. Employees are more likely to stay with an employer that demonstrates care for their financial health. Additionally, competitive benefits, including financial support, can attract top talent during recruitment. - ESTEEM

Physical and Mental Health:

Financial stress can lead to health issues, both physical and emotional. It can contribute to anxiety, depression, and other stress-related disorders. By addressing financial well-being, employers can positively impact the overall health and well-being of their workforce. Financial stress may lead to absenteeism due to health issues or personal matters. By providing resources and education to improve financial literacy and stability, employers can help reduce the number of days employees need to take off work. - PHYSIOLOGICAL NEEDS

Morale and Company Culture:

Employees who feel supported in their financial journey are more likely to have a positive perception of their employer. This contributes to a positive company culture, higher morale, and stronger employee relationships. Financial struggles can spill over into workplace relationships, causing tension and affecting teamwork. A supportive environment that addresses financial well-being can lead to better collaboration and stronger working relationships. - SENSE OF BELONGING

Productivity and Creativity:

Financial stability allows employees to focus on their tasks without distractions, fostering a creative and productive work environment. Financial worries can hinder problem-solving abilities and innovation. This could be a contributing factor to an employee feeling stuck.

So this is how we strategise financial well-being in the workplace at White Recruitment and what implementations we have in place:

We have partnered with Pembroke Financial who look after our staff with financial well-being, budgeting, mortgages and saving plans.

What’s great about this is the rewards for our staff with this initiative.

When employees start, it’s important to understand what they want to plan for with regards to financial expectations for their lifestyle.

Do they want to go on exotic holidays, save for a car, house or wedding?

By investing in our staff's life goals and financial expectations - we then want to be the best we can be as employers, by providing them with the resources available, to invest in financial education to make these dreams a reality.

https://pembrokefinancial.co.uk/about/